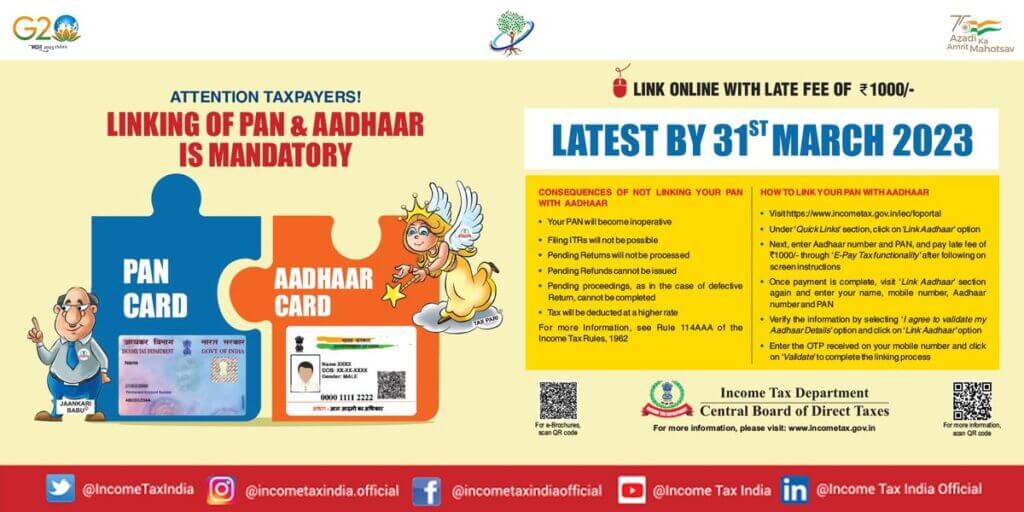

All people in India must link their Aadhaar cards with their Permanent Account Numbers (PANs) by March 31, 2023, according to a recent order from the Indian Revenue Department. The PAN will stop functioning if this instruction is not followed. Under the Income Tax Act of 1961, connecting the two documents is a requirement for everyone.

Follow these easy steps to verify the status of your PAN-Aadhaar card link online:

1. Open the Income Tax e-filing Portal and go to the homepage. Click on “Quick Links.”

2. After clicking “Aadhaar Status,” fill up the two fields with your PAN and Aadhaar numbers.

3. After the server has verified the status, a pop-up notification will appear. The message “Your PAN is already linked to the specified Aadhaar” will appear if your Aadhaar and PAN are linked. The message will state if they are not connected, “PAN is not connected to Aadhaar. To link your Aadhaar with your PAN, kindly click the “Link Aadhaar” button.”

4. You will notice the message, “The connecting process is in progress,” if it is “Your request to link your Aadhaar and PAN has been sent to UIDAI for verification. Please visit the ‘Link Aadhaar Status’ link on the homepage later to check the status.”

By going into the Income Tax portal and taking the following actions, you can also verify the status of the Aadhaar-PAN link:

1. After logging in, go to the homepage’s “Dashboard” section.

2. Choose the option to “Link Aadhaar Status” or go to “My Profile” and select the same option.

3. The Aadhaar number will be shown if your PAN and Aadhaar are connected. The “Link Aadhaar Status” will be shown if not.

4. If the request to link your Aadhaar with your PAN is still pending with UIDAI, the website will prompt you to check the status later.

You can change your information in either your PAN or Aadhaar database so that both documents have the proper information if linking your PAN and Aadhaar is impossible because your name, phone number, or date of birth are incorrect.

Moreover, the IT Department has made it possible to use SMS to verify the Aadhaar-PAN connection status. You can get updates on the link’s status by sending an SMS to the numbers 567678 or 56161. The message will say, “Aadhaar is already associated with PAN in ITD Database,” if the connection is already made. Otherwise, the message will state: “Your PAN (number) in the ITD Database is not linked to your Aadhaar. We appreciate you using our services.”

In conclusion, linking your PAN and Aadhaar is crucial to preventing future inconvenience. You can check the link status via the e-filing portal, the IT website, or SMS thanks to the Income Tax Department’s simple and accessible approach.